Anúncios

Receive funds fast, without complicated paperwork

Wonga Personal Loans are designed to give South Africans effortless access to short-term credit. With a fully digital platform, they provide fast solutions for financial needs.

Wonga isn’t your average lender. They focus on responsible lending and tech-driven financial inclusion, helping customers manage their borrowing responsibly and with full transparency.

Want to understand how Wonga stands out from traditional lenders? Keep reading to explore the features, benefits, and application process for Wonga Personal Loans.

| APR | Varies by loan and term (example: R4000 over 6 months = R5811.78) |

| Loan Purpose | Short-term personal expenses |

| Loan Amount | R500 to R5,000 (new); up to R8,000 (existing customers) |

| Credit Score Requirement | Not publicly disclosed; affordability assessment applies |

| Origination Fee | Included in total loan cost (transparently shown before acceptance) |

Loan

Wonga Personal Loans

A closer look at the core elements of Wonga Personal Loans

To begin with, Wonga loans are tailored for short-term borrowing, with repayment periods between one and six months. New customers can access up to R5,000, while existing ones may qualify for R8,000.

Moreover, the loan application process is 100% digital and available 24/7. From selecting the loan amount to receiving funds, it all happens online, with no paperwork required.

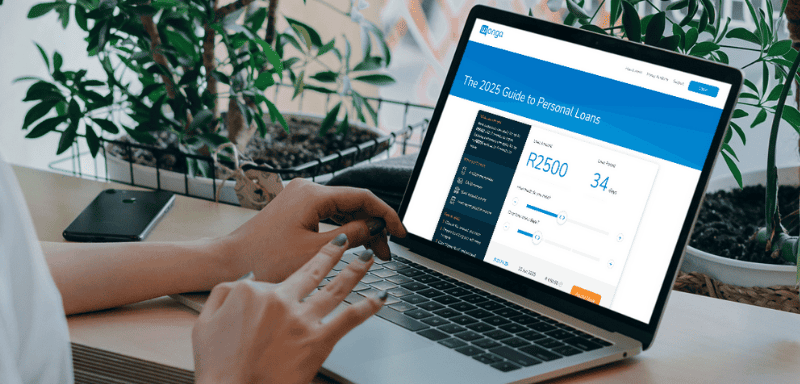

Additionally, a unique feature is Wonga’s personal loan calculator, which offers a detailed view of monthly repayments, total costs, and dates—helping users make informed decisions before borrowing.

Importantly, repayment terms are clearly laid out, and Wonga encourages early repayment to help customers reduce interest, reflecting their commitment to fair and responsible lending.

Exploring all facets of Wonga Personal Loans: benefits and drawbacks

Wonga loans offer an efficient financial solution. However, it’s important to evaluate both advantages and limitations before applying.

Benefits

- Fast and easy online applications: The loan application process is completely digital, takes only a few minutes, and allows you to apply from anywhere at any time.

- Transparent and upfront costs: Wonga provides a full breakdown of fees and total repayment amounts before you commit, so there are no surprises.

- Flexible repayment options: You can choose to repay your loan over 1 to 6 months, allowing you to manage your budget based on what works best for you.

- Encourages early repayment: There are no penalties for paying off your loan early, which helps reduce the total interest you pay and supports financial responsibility.

Drawbacks

- Limited loan amounts for new customers: New applicants can only borrow up to R5,000, which may not meet all financial needs in more urgent or significant situations.

- Short repayment period: Loans must be repaid within a maximum of 6 months, which might not be ideal for those looking for long-term credit solutions.

- Impact of late payments: Missing a repayment may result in additional charges and could negatively affect your credit record, making future borrowing more difficult.

- Unclear credit score criteria: While Wonga does perform affordability checks, they do not clearly state minimum credit score requirements, leaving applicants uncertain about approval chances.

Your guide to requesting Wonga Personal Loans: let’s get started

Applying for Wonga Personal Loans is simple, secure, and fast. With a mobile-friendly process, you can apply and get funds directly into your account in minutes.

To find out exactly how to apply and what you’ll need, follow the full step-by-step guide below and get started today with confidence.

Who can apply? Checking if you’re eligible

To be eligible for a Wonga Personal Loan, you must be a South African citizen or permanent resident, aged 18 or older, with a valid South African ID.

In addition, applicants need a working cellphone number and an active bank account. This ensures that Wonga can communicate with you and transfer funds when your loan is approved.

You must also provide your most recent proof of income during the application. This helps Wonga assess your affordability and commitment to responsible borrowing.

Finally, Wonga performs a full affordability assessment before granting loans. This protects customers from borrowing more than they can afford to repay on time.

Pick the way you’d like to apply for Wonga Personal Loans

Wonga operates exclusively online. You cannot apply in person or by phone. All loan applications must be submitted through their official website using your device.

The application starts by selecting your desired loan amount and repayment term through the digital slider on Wonga’s homepage. This step is simple and intuitive.

Next, you complete a secure online form with your personal details and upload your proof of income. The platform ensures data safety and confidentiality throughout the process.

Once submitted, your application is reviewed instantly. If approved, funds are disbursed directly into your bank account, often within minutes—no physical branch visit required.

Loan

Wonga Personal Loans

Taking a look at other available financial resources: FNB Personal Loan

While Wonga Personal Loans provide fast and flexible credit solutions, they may not meet the needs of individuals seeking larger loan amounts or longer repayment terms.

In these cases, FNB Personal Loan stands out as a strong alternative, offering loans of up to R360,000 with terms as long as 72 months and fixed monthly repayments.

Furthermore, FNB offers personalized interest rates based on your credit profile and includes credit life insurance for peace of mind, helping you stay financially secure in unexpected situations.

The loan application process at FNB is flexible—via app, online banking, or in-branch—with quick decisions and top-up options for existing loan clients.

To better understand how FNB can support your financial goals, visit our detailed guide on the FNB Personal Loan and learn how it compares to your current credit options.

Related Content