Anúncios

Powerful personal lending from a trusted institution

Standard Bank delivers accessible financing solutions tailored to South African borrowers. With Standard Bank Personal Loans, you can secure funds quickly and reliably.

Eligible clients can access up to R300 000 with personalised interest rates. Applications are quick and seamless, available online or via the Banking App in just a few minutes.

Loan

Standard Bank Personal Loans

Thanks to flexible repayment terms and a wide variety of loan types including term, revolving, overdraft, and energy loans. Standard Bank meets a broad range of financial needs.

Want to know how to take the next step and apply with confidence? Continue reading to learn how you can request your Standard Bank Personal Loan online today.

| APR | Loan Purpose | Loan Amount | Credit Score Requirement | Origination Fee |

|---|---|---|---|---|

| Up to prime +17.5% APR | Personal needs, home upgrades, emergencies, solar energy | R3 000 to R300 000 | Must be 18+, with valid ID and qualifying income | R419.75 – R1 207.50 (VAT incl.), R69 monthly fee |

A closer look at the core elements of Standard Bank Personal Loans

Standard Bank offers various loan types, including Term Loans, Revolving Loans, Energy Loans, and Overdrafts, with amounts reaching up to R300 000 and terms from 12 to 84 months.

Term Loans are ideal for structured budgeting. They offer fixed repayments and are available to clients earning a minimum of R3 000 per month.

Revolving Loans offer flexibility by allowing reuse of available credit after repaying just 15%. These require a higher income of R8 000 per month.

Interest rates are personalised and can go as high as prime +17.5%, depending on your credit score and affordability assessment in line with NCA regulations.

Representative Example:

- Loan Amount: ZAR 50,000

- Loan Term: 36 months

- Interest Rate: 18% p.a. (fixed, representative rate within the range up to prime + 17.5%)

- Initiation Fee: ZAR 1,207.50 (once-off, VAT included)

- Service Fee: ZAR 69 per month

- Monthly Repayment: approximately ZAR 1,808

- Total Cost of Credit: ZAR 65,088 (includes principal, interest, initiation, and monthly service fees)

This example is for illustration purposes only. Actual loan terms, interest rates, and fees depend on your credit profile, income, and affordability assessment. All credit is subject to approval under the National Credit Act (NCA). For precise and updated information, please visit Standard Bank’s official website or consult directly with a Standard Bank representative.

Exploring all facets of Standard Bank Personal Loans: benefits and drawbacks

Standard Bank provides fast and reliable access to credit. Its wide loan selection and digital services make it a strong choice for many South Africans.

Benefits

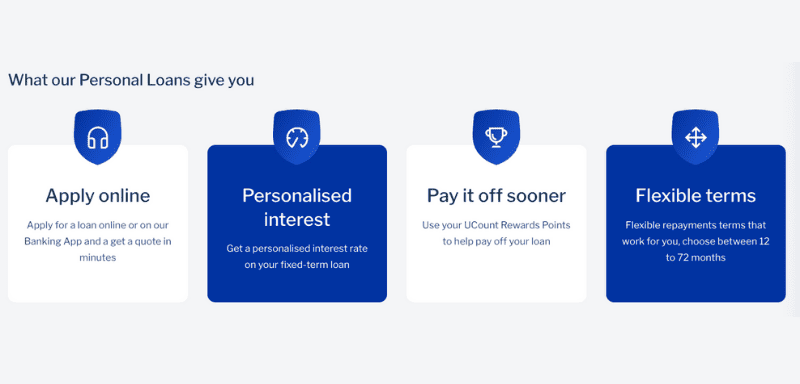

- Standard Bank Personal Loan application online is fast and intuitive. Get pre-approved and receive a quote in minutes via Internet Banking or the Banking App.

- Flexible repayment terms ranging from 12 to 84 months allow you to select what works best for your financial situation and long-term planning.

- Once approved, the quick loan money is deposited directly into your account, often on the same day, ensuring rapid financial relief.

- UCount Rewards Points can be used to pay down your loan, helping reduce the total repayment amount over time.

- You can choose from multiple loan types: Term Loans offer structure, Revolving Loans provide flexibility, and Energy Loans promote sustainability.

- Fees are disclosed upfront, including the monthly service and once-off initiation fees, offering full transparency from start to finish.

Drawbacks

- Quick loan easy setup includes monthly fees of R69 and initiation costs ranging from R419.75 to R1 207.50, which can affect affordability for smaller loans.

- Personalised interest rates vary widely. Borrowers with lower credit scores may face rates up to prime +17.5%, increasing the overall cost.

- Revolving and overdraft loans require a higher income threshold of R8 000 per month, which may exclude many lower-income earners.

- Loan terms begin at 12 months, which may not suit those needing a very short-term solution for urgent but brief financial gaps.

- The minimum loan amount is R3 000, limiting the usefulness for borrowers needing smaller sums.

- Pre-qualification is not a guarantee. Final approval depends on a detailed credit and affordability assessment conducted during application.

Your guide to requesting Standard Bank Personal Loans: let’s get started

Understanding how to apply can help you move forward confidently. Follow the steps below to check your eligibility and start your application.

Who can apply? Checking if you’re eligible

To qualify for a Standard Bank Personal Loan, you must be 18 years or older and possess a valid South African ID or smart ID card.

You’ll need proof of income, such as your latest payslip or three months’ bank statements showing regular deposits into your account.

A valid proof of residence, dated within the last three months, is required. Examples include a utility bill or lease agreement in your name.

The income threshold varies: R3 000 per month is required for Term Loans, while Revolving and Energy Loans need a minimum of R8 000.

Your credit history plays an important role. A positive repayment record increases your likelihood of approval and may help secure better interest rates.

Pick the way you’d like to apply for Standard Bank Personal Loans

Standard Bank provides several ways to apply, whether you prefer a fully digital experience or would rather speak to a consultant, the bank accommodates your choice.

- Apply on Internet Banking: Receive a personalised quote and complete your application quickly and securely online.

- Apply through the Banking App: Assess affordability and select your loan product directly from your mobile device.

- Submit a callback request online: Let a Standard Bank agent guide you through the process from start to finish.

- Use Cellphone Banking or visit a branch: Dial 1205626# or speak to a consultant for in-person assistance.

Standard Bank ensures a streamlined experience, no matter the method you choose, from application to final payout.

Getting your hands on Standard Bank Personal Loans: the journey ahead

Applying online is fast, efficient, and built to provide clarity. You’ll know your estimated costs before committing and receive your funds with minimal delay.

- Log in to Internet Banking or the Banking App and ensure your personal information is current.

- Navigate to Personal Lending and select Term Loan, Revolving Loan, or Energy Loan based on your objective.

- Use the loan calculator to estimate monthly repayments. You’ll receive a quote tailored to your credit profile and income.

- Accept the quote and submit your application. Upon approval, funds are transferred to your transactional account, often within hours.

This entire digital process puts control in your hands, removing paperwork, saving time, and making credit access more inclusive and responsive.

Loan

Standard Bank Personal Loans

Taking a look at other available financial resources: Wonga Personal Loans

After reviewing the advantages of Standard Bank Personal Loans, it’s clear they offer flexible solutions tailored to various budgets and needs across South Africa.

Yet, if you’re seeking a smaller loan amount with a shorter term, Wonga Personal Loans may offer the simplicity and speed you’re looking for.

Wonga is known for its quick, fully online process, ideal for borrowers needing urgent financial help without long-term commitment or complex paperwork.

Everything from choosing your amount to receiving funds happens online. Wonga makes it easy to understand your total repayment before applying.

To see whether Wonga’s short-term solution suits your situation better, keep reading for details on eligibility, features, and the simple application process.

Related Content

Wonga Personal Loans

Disclaimer: This content is for general information purposes only and does not constitute financial advice. We do not provide or arrange credit. Always conduct your own due diligence and consult a qualified financial professional before entering into any credit agreement. All credit comes at a cost. Ensure you fully understand the Total Cost of Credit and can afford the repayments before applying. Lending rates, terms, and product availability are subject to change. For the most accurate and current information, please refer to the official website of the credit provider.