Anúncios

Get flexible terms with the Capitec Bank Personal Loan

Capitec Bank remains one of South Africa’s most reliable financial service providers, offering smart and simple credit options to everyday individuals.

Building on that trust, the Capitec Bank Personal Loan provides up to R500,000 with flexible repayment terms and fast approval, giving clients the financial tools they need with clarity and control.

To help you decide if this solution is right for your situation, it’s important to explore the details. Continue reading to see how this loan could support your financial goals.

| APR | Loan Purpose | Loan Amount | Credit Score Requirement | Origination Fee |

|---|---|---|---|---|

| From 13% to 27.75% p.a. | Personal and consolidation | Up to R500,000 | Subject to credit and affordability check | Included in monthly repayment |

Loan

Capitec Bank Personal Loan

A closer look at the core elements of Capitec Bank Personal Loan

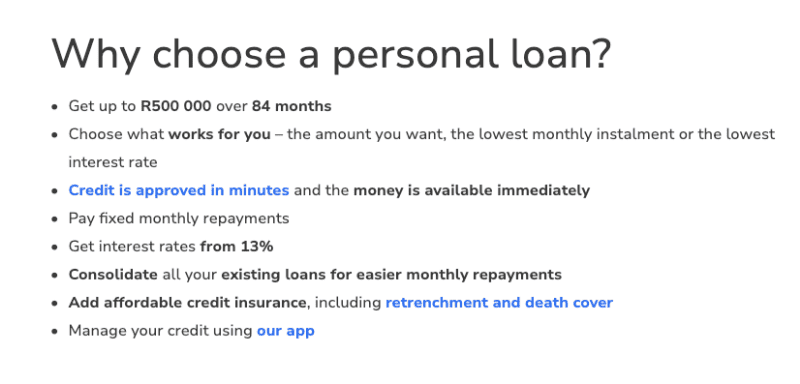

The Capitec Personal Loan interest rate starts from 13% per annum, with a maximum of 27.75%, based on your credit and affordability profile.

Applicants can request amounts up to R500,000 and choose repayment terms between 12 and 84 months depending on what suits their budget.

By using the personal loan calculator at Capitec Bank, users can preview their monthly repayment, making financial planning clearer and more realistic.

Moreover, loan approval is completed within minutes. Once approved, the funds are made available immediately, offering fast access when it’s needed most.

Representative Example:

- Loan Amount: ZAR 50,000

- Loan Term: 36 months

- Interest Rate: 13% p.a. (fixed, representative minimum)

- Initiation Fee: included in monthly repayments (exact amount depends on loan size)

- Service Fee: ZAR 69 per month

- Monthly Repayment: approximately ZAR 1,680

- Total Cost of Credit: ZAR 60,480 (includes principal, interest, service, and initiation fees)

This example is provided for illustration purposes only. Actual interest rates and fees vary according to your personal credit profile, affordability assessment, and loan amount. All credit is subject to approval and governed by the National Credit Act (NCA). For complete and updated terms, please visit Capitec Bank’s official website.

Exploring all facets of Capitec Bank Personal Loan: benefits and drawbacks

With a strong reputation for quick approvals and flexible loan terms, Capitec’s personal loan is a convenient solution for managing personal expenses.

To help you weigh your decision carefully, the next section outlines the key advantages and potential limitations of this loan option.

Benefits

- Loan amounts up to R500,000 offer flexibility for diverse needs, from renovations and education to covering emergencies or consolidating debt into one manageable payment.

- Instant credit decisions allow borrowers to find out within minutes if they qualify, helping them address urgent financial needs quickly and with confidence.

- Manage your loan easily via Capitec’s intuitive mobile app, enabling customers to track their balance, view repayment schedules, and update information conveniently.

- Add affordable credit insurance that includes protection against retrenchment, temporary disability, permanent disability, and death, ensuring your loan doesn’t burden your family.

Drawbacks

- Credit and affordability assessments required, potentially excluding applicants who are self-employed, have inconsistent income, or a poor credit history.

- Interest rates can be high for those with low credit scores, possibly reaching up to 27.75%, which significantly affects total repayment over the loan term.

- Origination and service fees are included in the monthly repayments, increasing the total cost of the loan and making it important to review full repayment estimates.

- Credit insurance is mandatory, which, while beneficial, still adds an extra cost that applicants must include in their budgeting and decision-making.

Your guide to requesting Capitec Bank Personal Loan: let’s get started

Applying for a Capitec Bank Personal Loan is quick and easy, with multiple channels available to suit your preference and schedule.

Keep reading to explore the step-by-step process for submitting your application and receiving your funds efficiently.

Who can apply? Checking if you’re eligible

Applicants must be at least 18 years old and provide a valid South African ID document as proof of identity. This serves as the fundamental eligibility requirement.

In addition, you must earn a regular monthly income of at least R3,000. This allows Capitec to evaluate your ability to repay the loan without compromising your financial stability.

You’ll also need to provide your most recent payslip and three consecutive salary deposit statements, especially if your salary isn’t paid into a Capitec account.

Finally, Capitec examines your credit history, banking behaviour, and monthly expenses to structure an offer aligned with your financial profile and repayment capacity.

Pick the way you’d like to apply for Capitec Bank Personal Loan

You can complete a loan application online through the official Capitec website by selecting your desired loan amount and submitting your personal and financial information.

Alternatively, use the Capitec banking app to start a loan online request directly from your mobile device with your digital banking profile.

You may also call Capitec directly at 0860 66 77 89 to speak with a consultant and complete your loan application telephonically.

Finally, if you prefer in-person assistance, visit any Capitec branch nationwide with your ID, latest payslip, and three months’ bank statements (if not banking with Capitec).

Getting your hands on Capitec Bank Personal Loan: the journey ahead

Applying online is one of the fastest ways to access your Capitec Loan. The steps below guide you through the complete process for digital application.

- Visit the official Capitec Bank website and navigate to the Personal Loan section.

- Use the personal loan calculator to explore your repayment options.

- Select your desired loan amount and preferred repayment term.

- Complete the online application form with your personal and income information.

- Upload required documents like your ID, latest payslip, and bank statements if necessary.

- Review your application and submit it for a credit and affordability check.

- Receive an instant decision and access funds if approved.

Completing your application online provides convenience and speed, allowing you to handle everything from your home or mobile device in just minutes.

Loan

Capitec Bank Personal Loan

Taking a look at other available financial resources: Wonga Personal Loans

Capitec Bank Personal Loan offers flexibility, large loan amounts, and manageable repayment terms. However, it might not be ideal for short-term or small financial needs.

In such cases, Wonga Personal Loans stands out as a smart, fast, and fully digital alternative for those needing instant financial support without complex requirements.

Wonga offers loans ranging from R500 to R8,000, depending on your client status, and lets you calculate costs in advance using their personal loan calculator.

Their process is available 24/7, and you don’t need to visit a branch or fill out paperwork, making it ideal for emergencies and quick solutions.

To learn how Wonga could better suit your needs, check out the content indicated below for an in-depth look at their features, benefits, and application steps.

Related Content

Wonga Personal Loans

Disclaimer: This content is for general information purposes only and does not constitute financial advice. We do not provide or arrange credit. Always conduct your own due diligence and consult a qualified financial professional before entering into any credit agreement. All credit comes at a cost. Ensure you fully understand the Total Cost of Credit and can afford the repayments before applying. Lending rates, terms, and product availability are subject to change. For the most accurate and current information, please refer to the official website of the credit provider.