Anúncios

Access affordable credit and manage life’s expenses with ease and confidence

Capfin Loan provides South Africans with affordable, inclusive, and accessible loan options that support personal growth and community development.

Founded in 2010, Capfin has issued over 11.3 million successful loans and served more than 2.7 million customers. Its partnership with over 3,000 PEP and Ackermans stores enhances accessibility.

Whether you’re improving your home, paying school fees, or funding a side hustle, Capfin’s offerings support meaningful decisions and positive change. Continue reading to explore the full potential of Capfin’s financial solutions.

| APR | Loan Purpose | Loan Amount | Credit Score Requirement | Origination Fee |

|---|---|---|---|---|

| 5% monthly (first 6-month loan); 3% monthly thereafter; 28.5% p.a. max on >6 months | Home improvements, education, side hustles, emergencies | R1,000 – R50,000 | Based on affordability assessment | Included in monthly fees |

Loan

Capfin Loan

A Closer Look at the Core Elements of Capfin Loan

Capfin Personal Loan amounts range from R1,000 to R50,000, ensuring flexibility whether you’re handling small needs or major financial planning.

Monthly installments are fixed, covering capital, interest, and fees, making your loan application manageable with predictable payments over the loan term.

The Capfin loan calculator gives a repayment estimate including VAT, allowing applicants to determine the loan’s affordability before applying.

Interest and fees remain fixed, with the maximum annual rate set at 28.5%. Capfin also provides Credit Life insurance for extra financial security.

Representative Example:

- Loan Amount: ZAR 10,000

- Loan Term: 6 months

- Interest Rate: 5% per month (fixed)

- Initiation Fee: included in monthly repayments (exact amount depends on loan size)

- Service Fee: included in monthly repayments

- Monthly Repayment: approximately ZAR 1,930

- Total Cost of Credit: ZAR 11,580 (includes principal, interest, fees, and VAT)

This example is for illustration purposes only. Actual rates, fees, and repayment amounts may vary based on your affordability assessment and credit profile. All credit is subject to approval under the National Credit Act (NCA). For accurate and updated details, please refer to Capfin’s official website or visit your nearest PEP or Ackermans store.

Exploring All Facets of Capfin Loan: Benefits and Drawbacks

The Capfin Personal Loan offers an empowering lending experience tailored to unique South African financial needs.

Take a look at the pros and cons below to see if it’s the right fit for you:

Benefits

- Accessible Locations: Capfin partners with over 3,000 retail stores across South Africa, allowing customers to easily apply for loans in person.

- Quick Approval: Customers receive a personalised pre-approval offer within minutes and can expect full approval shortly after submitting documents.

- Loan Purpose Diversity: A wide range of uses, including home renovations, educational fees, emergency costs, and entrepreneurial ventures are all supported.

- Clear Repayment Terms: Monthly installments are fixed and transparent, covering principal, interest, fees, and Credit Life insurance for peace of mind.

Drawbacks

- Interest for Short-Term Loans: Initial loans under 6 months have a higher monthly interest rate of 5%, which can result in greater overall repayment.

- No Fixed Credit Score Requirement: Approval relies solely on affordability assessments, which might be unpredictable for some applicants.

- No Online Chat Support: The lack of live customer chat can make it harder for users to get immediate help or answers to time-sensitive questions.

- Document Upload Required: Applicants must scan or upload recent payslips or bank statements, which can be a barrier for those without access to digital tools.

Your Guide to Requesting Capfin Loan: Let’s Get Started

Applying for a Capfin Loan is quick, efficient, and designed with customer convenience in mind. Keep reading to learn exactly how to apply and what steps to follow for a successful application:

Who Can Apply? Checking if You’re Eligible

Capfin loans are available to South African citizens who are 18 years or older and have a valid South African ID document.

Applicants must also have an active South African bank account, which is required to process monthly debit orders for the loan repayments.

To complete the application, customers need to provide their latest three months’ payslips or bank statements to verify their income and assess affordability.

A valid cellphone number is necessary for communication, updates on the loan application status, and to confirm the DebiCheck mandate securely.

Pick the Way You’d Like to Apply for Capfin Loan

Capfin offers multiple ways to apply, ensuring flexibility and convenience for every applicant regardless of their location or preferred communication method.

Applying online is fast and simple. You can visit the Capfin website, fill in the application form, upload your documents, and receive your pre-approval in minutes.

If you prefer using SMS, simply send your South African ID number to 33005. Capfin will guide you through the next steps via your cellphone.

For those who prefer in-person assistance, applications are available at any PEP or Ackermans store. Staff members will assist in scanning and uploading your documents securely.

Capfin also supports document submission via email or fax. For added ease, they can access bank statements directly from select South African banks.

Getting Your Hands on Capfin Loan: The Journey Ahead

If you prefer the convenience of applying online, Capfin ensures a simple and quick process designed to get you approved and funded in just a few steps.

- Visit the official Capfin website and navigate to the loan application section.

- Complete the online form by filling in your personal and employment details accurately.

- Upload your latest three payslips or bank statements directly to the platform.

- Review your pre-approved offer and confirm your desired loan amount and repayment term.

- Submit your banking details and approve the DebiCheck mandate sent by your bank.

This structured approach ensures your application is handled efficiently and transparently, with funds disbursed within 48 hours of final approval.

Capfin’s online application is ideal for those seeking fast, reliable financial assistance with minimal paperwork and maximum convenience from home.

Loan

Capfin Loan

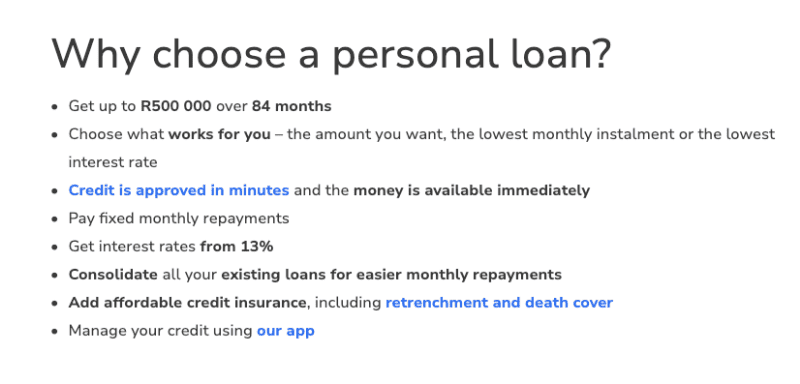

Taking a Look at Other Available Financial Resources: Capitec Bank Personal Loan

Capfin Loan offers convenience, transparency, and fast access to funds for home improvements, education, or emergencies. But it’s not the only trusted option available.

Capitec Bank Personal Loan is a compelling choice, offering up to R500,000 with flexible repayment terms ranging from 12 to 84 months, based on affordability.

Interest rates start from 13% and go up to 27.75% annually. Approval is instant, and funds are transferred quickly for urgent financial needs.

You can apply online, in-app, via phone, or by visiting a Capitec branch. Capitec also includes optional credit insurance with their loan services.

To learn more about how Capitec’s loan solution may fit your needs, check out our dedicated content on Capitec Bank Personal Loan and compare with confidence.

Related Content

Capitec Bank Personal Loan

Disclaimer: This content is for general information purposes only and does not constitute financial advice. We do not provide or arrange credit. Always conduct your own due diligence and consult a qualified financial professional before entering into any credit agreement. All credit comes at a cost. Ensure you fully understand the Total Cost of Credit and can afford the repayments before applying. Lending rates, terms, and product availability are subject to change. For the most accurate and current information, please refer to the official website of the credit provider.