Anúncios

Discover why Boodle stands out in lending

Boodle Loan provides online access to short-term funds in South Africa. Applicants may qualify for amounts of up to R8 000, depending on their profile and repayment history.

Digital applications are processed quickly, with funds often paid out shortly after approval. This can be helpful in situations requiring fast financial support.

This article outlines key aspects of Boodle Loan, including eligibility, application methods, and relevant costs, to help users make informed decisions.

| APR | Loan Purpose | Loan Amount | Credit Score Requirement | Origination Fee |

|---|---|---|---|---|

| 60% (Max APR) | Short-term personal | R1 000 to R8 000 (depending on customer profile) | South African ID, income proof, bank account required | R165 + 10% of loan amount above R1 000, capped at 15%, plus 15% VAT |

Loan

Boodle Loans

A closer look at the core elements of Boodle Loan

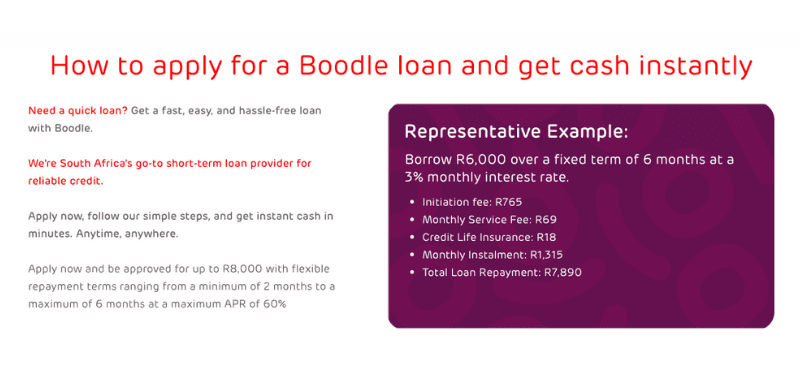

Boodle offers unsecured short-term loans tailored for urgent financial needs. Depending on your SmileRank®, you may qualify for loan amounts ranging from R1 000 to R8 000, depending on customer profile and repayment history.

Loan terms range from 2 to 6 months, allowing flexibility in planning repayments that suit your personal circumstances and budget.

The daily interest rate is 0.17%, with a capped maximum APR of 60% annually. These rates comply with South Africa’s National Credit Act.

New loans include a once-off initiation fee: R165 plus 10% of the amount above R1 000, capped at 15% and subject to 15% VAT.

Borrowers also pay a monthly service fee of R60 plus VAT. Optional credit life insurance is calculated at around R4.50 per R1 000 of the balance per day.

Representative Example:

- Loan Amount: ZAR 4,000

- Loan Term: 3 months

- Interest Rate: 0.17% per day (≈ 5.1% per month)

- Initiation Fee: ZAR 165 + 10% of amount above R1,000 = ZAR 465 (plus 15% VAT)

- Service Fee: ZAR 60 per month (plus VAT)

- Monthly Repayment: approximately ZAR 1,460

- Total Cost of Credit: ZAR 4,380 (includes principal, interest, initiation and service fees, plus VAT)

This example is for illustration purposes only. Actual loan amounts, interest rates, and fees depend on your individual credit profile, affordability assessment, and selected repayment term. All credit is subject to approval and regulated under the National Credit Act (NCA). For the most accurate and updated information, please visit Boodle’s official website.

Exploring all facets of Boodle Loan: benefits and drawbacks

Understanding the strengths and limitations of Boodle Loan helps you decide if it’s the right fit. Below, we highlight its most important pros and cons.

Benefits

- Fast approval and payout—usually within ten minutes—make Boodle ideal for urgent financial needs.

- Loan amounts between R1 000 and R8 000 cover a variety of short-term expenses with manageable repayment plans.

- Costs are disclosed upfront, including interest, service fees, and insurance—so there are no surprises.

- The fully online process is available 24/7, eliminating the need for paperwork or in-person visits.

Drawbacks

- The R8 000 loan limit may not be sufficient for those facing larger or ongoing expenses.

- Long repayment terms can result in increased fees and interest, especially with optional insurance and VAT.

- No physical branches or call-in services; all support happens digitally, which may not suit everyone.

- Verification of income and banking details can delay approval for first-time applicants.

Your guide to requesting Boodle Loan: let’s get started

Applying for a Boodle Loan is quick and simple. You can do everything online using your mobile device or computer, with funds disbursed shortly after approval.

The process is designed to be user-friendly and intuitive. With clear steps and digital convenience, it’s ideal for covering unexpected costs without delay.

In the next sections, you’ll find who qualifies, how to apply, and what happens once your loan is approved. Read on to be fully informed.

Who can apply? Checking if you’re eligible

To qualify, applicants must be at least 21 years old and reside in South Africa with valid identification.

You must have a stable income. This helps Boodle assess your repayment ability and ensures responsible lending for both parties.

An active South African bank account is essential, as all loan disbursements and repayments happen through this account.

Supporting documents such as payslips and recent bank statements are required to complete your application.

First-time applicants may experience longer verification times. Returning users with a strong SmileRank® enjoy faster approvals and higher loan limits.

Pick the way you’d like to apply for Boodle Loan

Boodle loans can only be applied for through their official website. You’ll need a smartphone, tablet, or computer with internet access.

No physical branches or in-store services are available, as the entire platform is built around digital convenience.

Phone applications are also not supported, reinforcing the online-only nature of Boodle’s system.

Customer support is provided via email or through your Boodle account dashboard—ensuring prompt and clear communication.

Getting your hands on Boodle Loan: the journey ahead

Boodle makes getting a loan quick, easy, and secure—especially for South Africans who need cash fast and without extra hassle.

- Step 1: Go to the Boodle website on your desktop or smartphone.

- Step 2: Use the SmileDial® to choose how much you want to borrow and for how long.

- Step 3: Create an account or log in, then enter your personal details, income info, and bank account.

- Step 4: Upload the required documents and wait briefly while Boodle processes your credit and affordability check.

- Step 5: Once approved, the money is paid directly into your bank account, and you’ll receive your repayment schedule.

After disbursement, your repayments follow the schedule you agreed to. Boodle provides reminders to help keep you on track.

Loan

Boodle Loans

Taking a look at other available financial resources: Wonga Personal Loans

While Boodle Loan is fast and accessible, it may not meet everyone’s needs—especially if your financial situation requires more flexibility or different loan terms.

In these cases, Wonga Personal Loans offer an alternative. They provide quick funds with a focus on transparency and responsible lending practices.

The entire Wonga process is digital. There’s no paperwork or branch visit required, and their loan calculator shows all costs before you apply.

Wonga aims to serve South Africans with clear, tech-forward solutions—helping users manage credit responsibly and avoid over-indebtedness.

To learn more about how Wonga compares to Boodle, continue to the next article for detailed features, benefits, and eligibility information.

Related Content

Wonga Personal Loans

Disclaimer: This content is for general information purposes only and does not constitute financial advice. We do not provide or arrange credit. Always conduct your own due diligence and consult a qualified financial professional before entering into any credit agreement. All credit comes at a cost. Ensure you fully understand the Total Cost of Credit and can afford the repayments before applying. Lending rates, terms, and product availability are subject to change. For the most accurate and current information, please refer to the official website of the credit provider.