Anúncios

Discover why Atlas Finance Loans is a trusted lender in South Africa

Atlas Finance Payday Loans provide fast and reliable loan options when emergencies strike. Their seamless online process and same-day payouts help South Africans address urgent financial needs with ease.

With more than 30 years of experience, Atlas Finance is a registered financial service provider that values responsible lending, even if you have no credit history or low scores.

Loan

Atlas Finance Payday Loans

If you’re looking for secure and convenient payday loan options, continue reading to discover how Atlas Finance can assist you.

| Loan Terms | Loan Purpose | Loan Amount | Credit Score Requirement | Origination Fee |

|---|---|---|---|---|

| 1 to 6 months | Short-term emergencies, daily needs | R500–R8 000 | No minimum credit score; affordability assessment required | Initiation fee and monthly service fee apply (in accordance with the National Credit Act; actual amounts vary depending on loan size and term) |

Note: Atlas Finance does not publicly disclose a specific APR. Fees are applied according to the National Credit Act guidelines.

A closer look at the core elements of Atlas Finance Payday Loans

Accessing payday loans is simple with Atlas Finance’s digital platform. The application takes just minutes and approvals are often granted within one hour.

Loan values range from R500 to R8 000, with repayment options from one to six months. You can apply without visiting a branch or dealing with paperwork in person.

While some lenders promote loans with no credit checks, Atlas prioritizes financial responsibility by evaluating your affordability and credit status.

Once your application is approved, funds are transferred directly to your bank account or NuCard, typically on the same day.

Representative Example:

- Loan Amount: ZAR 4,000

- Loan Term: 3 months

- Interest Rate: 5% per month (fixed, in line with NCA limits for short-term credit)

- Initiation Fee: ZAR 165 + 10% of the amount above R1,000 = ZAR 465 (plus 15% VAT)

- Service Fee: ZAR 60 per month (plus VAT)

- Monthly Repayment: approximately ZAR 1,460

- Total Cost of Credit: ZAR 4,380 (includes principal, interest, initiation and service fees, plus VAT)

This example is provided for illustration purposes only. Actual loan amounts, fees, and repayment schedules depend on your personal affordability and credit assessment. All credit is subject to approval and regulated under the National Credit Act (NCA). For accurate and updated information, please refer to Atlas Finance’s official website or visit a branch near you.

Exploring all facets of Atlas Finance Payday Loans: benefits and drawbacks

Atlas Finance Loans are designed for short-term emergencies, offering convenience, accessibility, and transparency. Below are some key advantages and considerations.

Benefits

- Approval can happen in as little as one hour, with funds transferred shortly after verification is complete.

- The entire process is fully digital, accessible via mobile or desktop, with no need to visit a branch.

- Approval considers employment and affordability, not only credit history. Even applicants with limited or no credit history may qualify.

- Atlas Finance discloses all applicable fees upfront, offering flexible repayment terms aligned with your income.

- Funds can be received via NuCard, adding an extra layer of security and speed.

- Backed by over 30 years of experience, Atlas operates more than 250 branches across South Africa.

Drawbacks

- Atlas performs credit and affordability checks to ensure responsible lending. Those under debt review or blacklisted may not be approved.

- The loan cap of R8 000 may not suit individuals facing more significant or ongoing financial obligations.

- Loan terms are capped at 6 months, which may not work for those needing extended repayment schedules.

- Uploading documentation such as payslips, ID, and bank statements is required, which could be a hurdle for some.

- Although legally regulated, service and initiation fees may increase the overall cost of the loan.

Your guide to requesting Atlas Finance Payday Loans: let’s get started

Getting a personal loan with Atlas Finance is straightforward. Here’s how to determine your eligibility and begin your application.

Who can apply? Checking if you’re eligible

To apply for a loan, you must be at least 18 years old and have a valid South African ID or a valid work permit.

Applicants are required to submit their latest payslip and three months of bank statements to confirm income and affordability.

You must earn a regular income—whether as a salaried employee or contractor—with your salary paid into a South African bank account.

Even if you lack a formal credit history or have previously been declined, you may still qualify if you meet affordability standards.

Atlas Finance assesses each application individually, providing fair access to credit for those who demonstrate the ability to repay.

Pick the way you’d like to apply for Atlas Finance Payday Loans

Atlas Finance offers several convenient application channels tailored to different preferences.

You can apply online via their official website using a desktop or mobile device, anytime.

Prefer face-to-face assistance? Visit one of the more than 250 branches across South Africa to apply in person.

Support is also available via phone if you need guidance through the process.

Alternatively, you can start your loan inquiry using their official WhatsApp contact for quick and easy communication.

Getting your hands on Atlas Finance Payday Loans: the journey ahead

The process is designed to be fast and hassle-free from start to finish.

- Choose your method – Apply online, visit a branch, use WhatsApp, or call for support.

- Submit your documents – Provide ID, bank statements, and a payslip through your chosen method.

- Undergo assessment – Atlas reviews your affordability and determines a suitable loan amount.

- Receive approval – Once approved—often within an hour—you’ll be notified immediately.

- Get your funds – Approved funds are deposited into your bank account or NuCard the same day.

This streamlined approach ensures reliable financial support when it’s needed most.

Loan

Atlas Finance Payday Loans

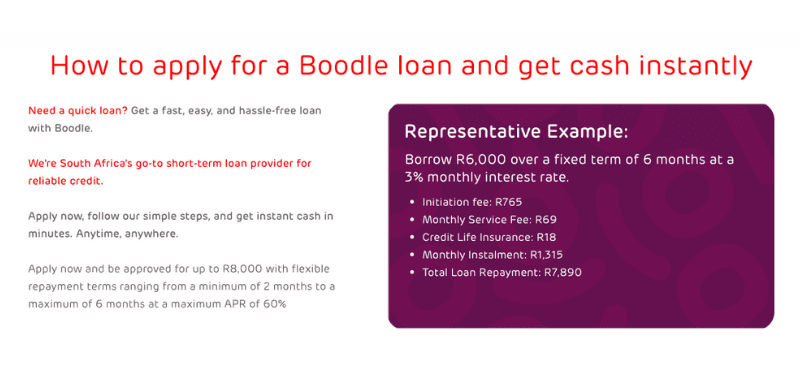

Taking a look at other available financial resources: Boodle Loan

Atlas Finance provides a strong payday loan option for South Africans who need funds fast, supported by decades of experience and a hybrid digital-branch network.

If you’re looking for a loan alternative that is 100% online, Boodle Loan may be a practical and efficient solution.

Boodle loans range from R1 000 to R8 000, depending on your profile and repayment history. Approval is fast and funds are often paid out within minutes.

They follow South Africa’s credit regulations and use a SmileRank® system to personalize offers and determine risk in a fair way.

To explore how Boodle compares with Atlas and whether it suits your needs, continue to the next article for full details.

Related Content

Boodle Loan

Disclaimer: This content is for general information purposes only and does not constitute financial advice. We do not provide or arrange credit. Always conduct your own due diligence and consult a qualified financial professional before entering into any credit agreement. All credit comes at a cost. Ensure you fully understand the Total Cost of Credit and can afford the repayments before applying. Lending rates, terms, and product availability are subject to change. For the most accurate and current information, please refer to the official website of the credit provider.